A lawsuit has been filed against the Ghana Revenue Authority (GRA) and the Finance Ministry over the 1 District 1 Factory Initiative, which aims to give tax waivers to 42 companies.

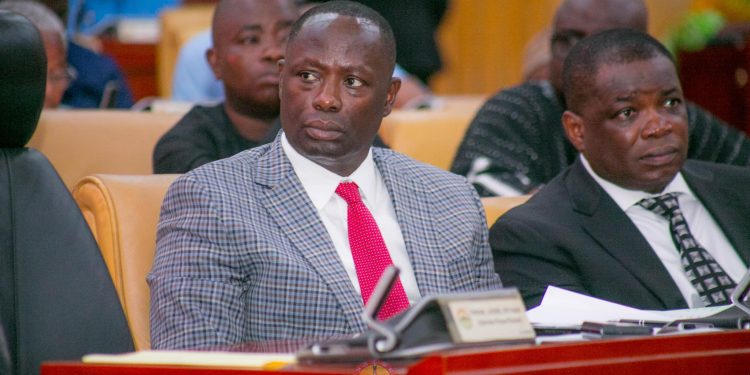

Three members of the minority in parliament, led by Emmanuel Armah-Kofi Buah, their deputy leader, filed the lawsuit.

The MPs contend that the tax waivers are not advantageous for the nation and ask the Supreme Court to halt them.

The three MPs, Emmanuel Armah-Kofi Buah (MP for Ellembelle), Kwame Agbodza (MP for Adaklu), and Bernard Ahiafor (MP for Akatsi South), claim that it is not in Ghana’s best interest for the GRA to issue these tax waivers.

They contend that the tax waivers are unlawful because they violate Article 174 of the 1992 Constitution and are therefore inconsistent with it. They are asking the Supreme Court to rule that the waivers are void and have no legal significance.

Bernard Ahiafor, one of the plaintiffs, pleads with the Supreme Court to get involved for the nation’s good.

If a citizen feels that a specific provision of the Constitution is being violated, they have the option to seek interpretation and declaration at the Supreme Court, the highest court, as it appears that Article 174 of the Constitution is being violated and the Supreme Court is granted exclusive jurisdiction to interpret.

“That is exactly what we have done in the circumstance, we’re seeking relief against the ones that are being implemented and the ones that are yet to be implemented,” he said.

About the tax waiver

On May 20, the government released a list of companies requesting tax waivers under the 1D1F initiative.

In 2021, the Ministry of Finance initiated processes to secure approximately $335,072,712.13 in tax exemptions for 42 companies participating in the government’s One District One Factory initiative.

The Exemptions Act, 2022 (Act 1083), was presented in Parliament by the former Minister for Finance, Ken Ofori-Atta, in 2022.

Among the companies, Sentuo Oil Refinery Limited, a newly established entity, has the highest requested exemption amounting to $164,633,012.00.