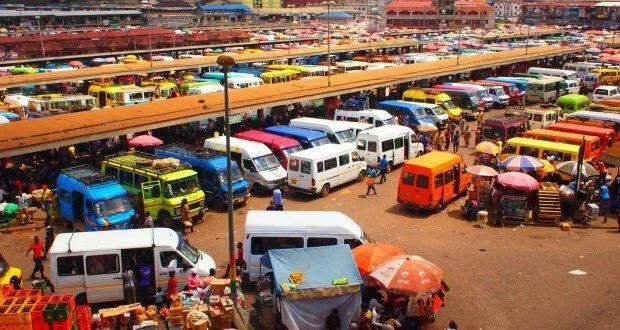

The Ghana Private Road Transport Union (GPRTU) has vowed to raise transportation costs by sixty percent in 2024, starting in January, when the Emission Levy Bill becomes operative.

Beginning in January 2024, all owners of gasoline and diesel vehicles would be subject to an annual fee of 100 cedis under the Emissions Levy Bill, which was approved by Parliament.

With this tax, the government hopes to promote the use of green energy sources for vehicle power, continuing its commitment to carbon offset programs and climate-positive efforts.

Mr. Imoro claims that since the Union is already taxed excessively, it would not be advantageous to impose further taxes.

He mentioned that the Speaker of Parliament has received a letter from the Union requesting that the Emission Levy Bill be reviewed.

“In the letter, we indicated that we will increase lorry fares by not less than 60% if nothing is done about it,” he stated.

He claims that this modification will help the drivers deal with any potential financial hardship brought on by the new fee.

The Minority in Parliament had earlier opposed the Emissions Levy Bill’s approval, claiming the tax was ill-considered.

Referred as the “wusie tax,” they contended that the charge levied on all private and commercial automobiles, ambulances, commercial motorbikes, and tricycles would exacerbate the nation’s already severe economic circumstances.

However, Dr. Matthew Opoku Prempeh, the Energy Minister, defended the measure by pointing out that the globe is moving away from internal combustion engines and that the new tax will help the nation enter the new era of electric vehicles.